- Taxpayers who cannot pay their tax bill on time can set up a time to pay arrangement with HMRC which can be done online.

- Setting up a time to pay arrangement online for self-assessment has been possible for several years.

- The self-assessment limit increased from £10,000 to £30,000 in October 2020.

- The ability to create an online time to pay arrangement was extended to employers PAYE in December 2022.

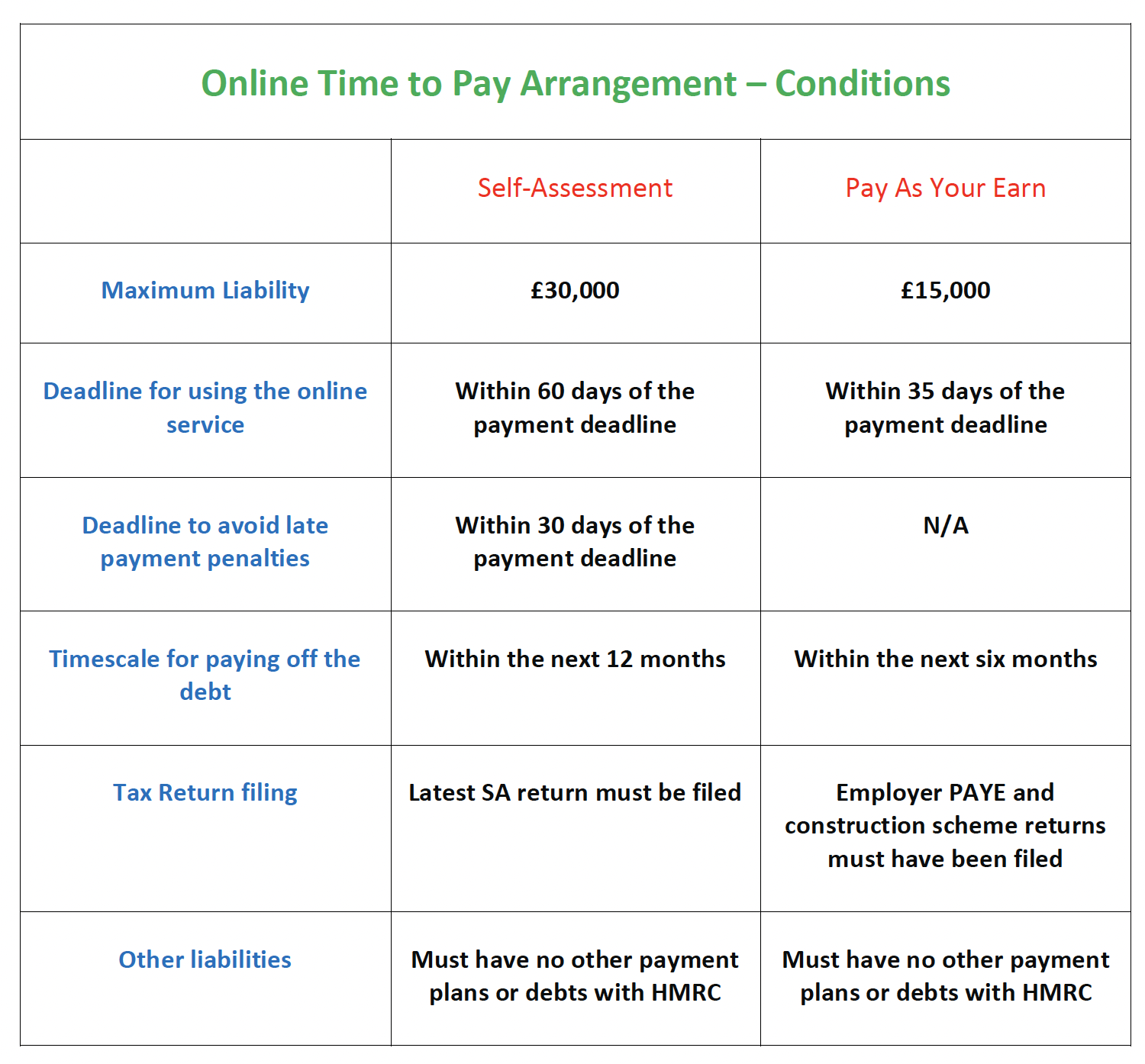

- The criteria for using the online services are

- If the taxpayer cannot meet these conditions, either they or their accountant will need to speak to HMRC or use the webchat.

- The HMRC Payment Support Service contact number is 0300 200 385.

- Agents cannot use the online service on behalf of their clients.

- Interest will be charged on payments made after the deadline.

- Click here to access the self-assessment online service and here for the PAYE service